This section is written specifically to help beginning investors and traders learn how to trade stock options online by illustrating with screenshots the practical steps of how to place limit orders with triggered GTC closing orders. Real ticker symbols are used to preserve the ‘real’ nature of this guide; however, the stocks mentioned are not to be interpreted as trade recommendations. Readers are advised that they are solely responsible for their own trading decisions.

The following two examples demonstrate how a trader with a bullish outlook on a particular stock (which may be based on either a news event or a technical breakout) may place orders after hours to buy CALLS at a LIMIT price. The first example shows the ‘BUY’ order only; the second example shows how one can simultaneously place a closing GTC (good till cancelled) order to be triggered if the ‘BUY’ order is filled. Forming a habit of placing a triggered GTC closing order forces the trader to define his/her expected profit, and protects from the emotional forces of GREED, which often sabotage even the savviest of traders.

How to Trade Stock Options Online – Step-by-Step Guide

Step 1: Only use limit orders to ‘open a trade’

First, Find a Stock you wish to place a trade on – here is one with a bullish bias.

Next, Open the Order Entry Screen

Next, Enter the Ticker Symbol

Next, Choose the Strategy.

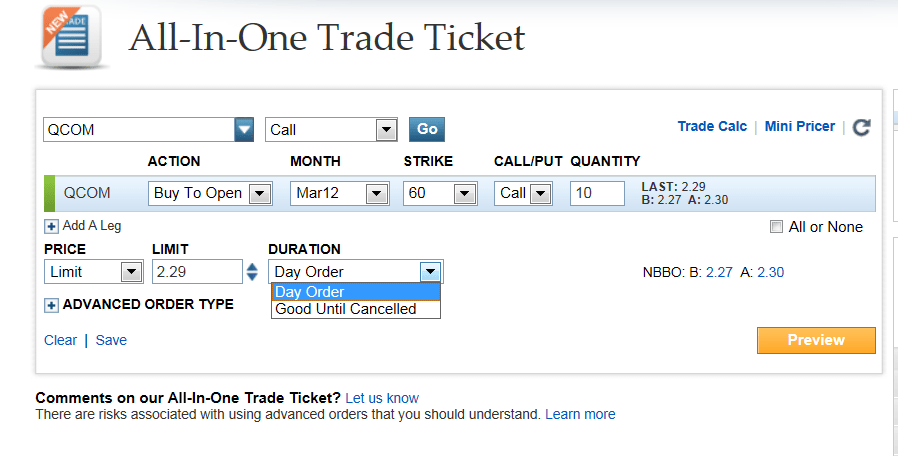

Choose the type (CALL). The steps to place orders for a stock or other strategies would be similar, except you would make a different choice from the list.

Next, Choose the BUY/SELL action

Next, Choose which month option to buy

Generally, one does not wish to buy options with less than 30 days to expiration as theta decay is extremely great in the last month.

Next, Choose the strike price

Generally, the at-the-money (ATM) strike is a good balance between cost and ‘delta’, although, if you expect a really strong move of the stock, an option one strike out-of-the-money may be a better choice.

Next, Choose the number of contracts

Remember that each contract usually controls 100 shares, so the cost of the transaction will be equal to the option premium multiplied by 100 (plus commissions).

Next, Pick a ‘LIMIT’ price as the type of order, and enter the amount ‘per contract’ you are willing to pay.

Next, Choose ‘Day order’ for entering a trade.

If the trade is not filled, the next day, review the trade, and ‘re-enter’ the trade if your outlook (bullish or bearish) is still the same.

Next, Click ‘Preview’ to see the details of the trade being entered into the system.

If the details are exactly as you intended, click ‘submit’. If you made a mistake, cancel the screen and repeat your steps to correct your mistake.

Step 2: Only use GTC orders to ‘close a trade’

Step 3: Place the closing order shortly after the opening order is executed

Many beginning investors and traders can and do learn ‘How to trade stock options Step 1’ as described above; however, many investors and traders attempt to trade options as they do stocks, and hence run into problems. Because options are ‘wasting assets’ and success or failure is often determined by ‘getting in’ and ‘getting out’ in a timely fashion, Steps 2 and 3 noted above are crucial.

The best time to place a closing order for a trade is immediately after the opening order is placed – hence, a ‘triggered’ order is best. Here’s how to place the ‘triggered’ order.

As described above, begin by identifying a stock you are bullish or bearish on.

Next, enter the details for a limit order as described above.

Next, To add a trigger for the Closing GTC order, click on the ‘Advanced Order Type’

Next, Complete the steps as before, but this time enter a LIMIT price higher than the previous one based on one’s profit target.

In this example, a LIMIT of 1.8 per contract in the ‘closing order’ is 50% more than the 1.2 per contract in the ‘opening order’; however, this does not take into account the commissions paid on both orders (which will reduce the ultimate profit to ‘only’ 40% in this instance).

Lastly, Preview your order, and click ‘SUBMIT’!

You’ve done it – you’ve entered a stock option trade that will only be entered at the LIMIT price you’ve determined, and, once entered, will be exited without you having to watch the market constantly.

Next Steps to learn How to Trade Stock Options Online Successfully

Despite the simplicity of the above steps, there is more to learn about investing and trading – see “Winning Trading Strategies” and “Timing the Market” to learn more about when to ‘get into’ the market. The steps illustrated above and principles described on other pages are applicable for both stocks and stock options. For those interested mainly in stock options, see “Option Trading Strategies”.

The above screenshots are from OptionsXpress, and are used with permission. Readers are advised to find a brokerage whose platform they can understand and use easily, and that has good support to help beginning investors and traders if they have difficulty or questions.

If you have money to invest, you should consider opening a brokerage account – not to invest initially, but to avail yourself of the many educational resources usually reserved for customers to learn how to invest and trade better. For example, OptionsXpress clients have access to a wealth of information in the form of How-to guides, videos and archived webinars, a virtual trading platform with real-time quotes, as well as free workshops and seminars. They will actually allow you to open an account and DO NOT require a minimum deposit before granting you access to the educational materials (see link below). You will however have to deposit money in the account to be able to invest any money.

Happy Trading!

JonLuc